Navigating the 2025 Housing Market: Interest Rate Trends, Fed Decisions, and Inventory Shifts in Q4

As we move through Q4 2025, the US housing market is experiencing significant fluctuations driven by shifting interest rates, slowing inflation, and reduced consumer purchasing power. Here's what homebuyers and investors need to know.

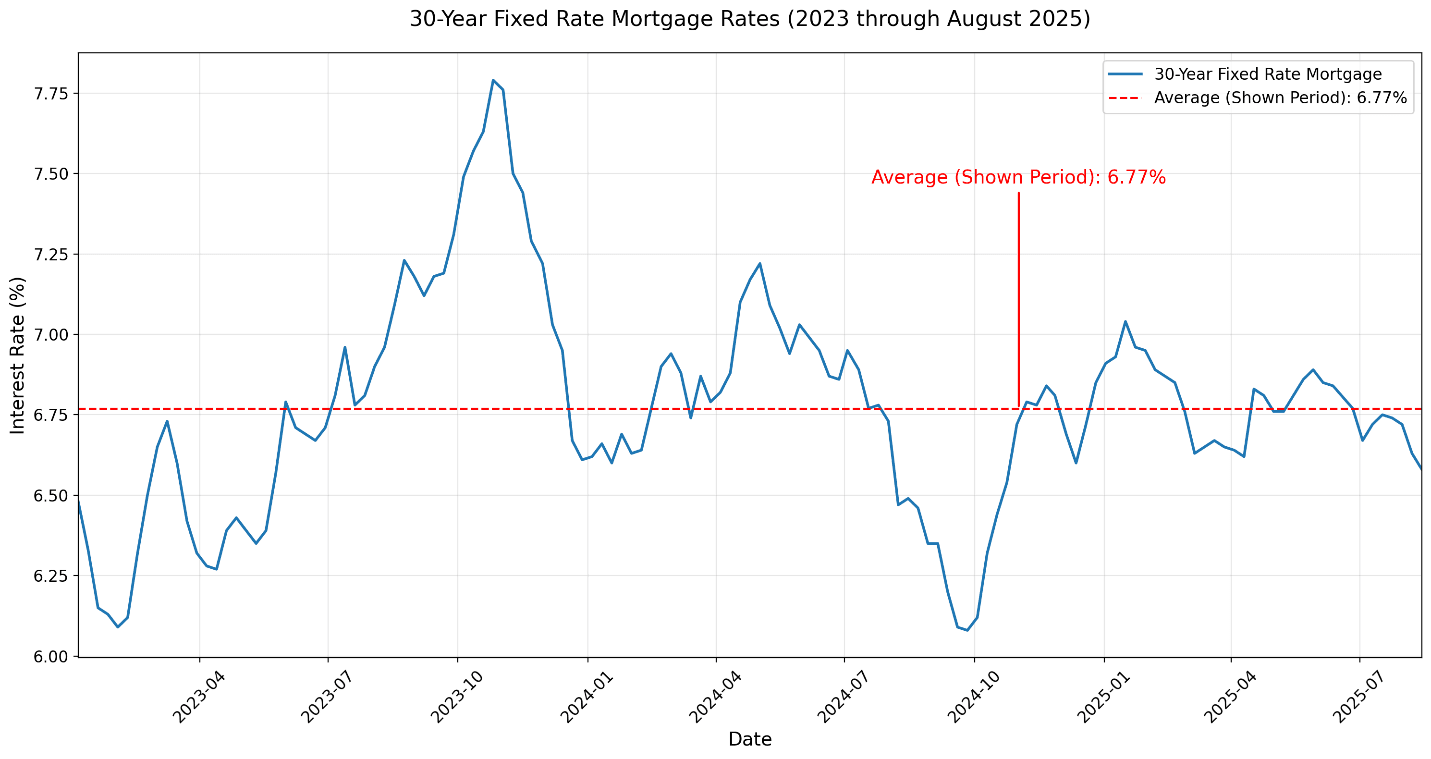

Source: themortgagereports.com

30-Year Fixed Mortgage Rates from 2023 through August 2025, showing a downward trend in recent months.

As we move through Q4 2025, the US housing market is experiencing significant fluctuations driven by shifting interest rates, slowing inflation, and reduced consumer purchasing power. With inflation easing to around 2.9% and unemployment at 4.3%, the Federal Reserve's actions are under intense scrutiny, influencing both conventional and investment loan rates. Homebuyers and investors are adapting to these changes, with inventory levels showing gradual improvement but remaining tight overall. This article explores the latest trends in interest rates for conventional and DSCR loans, potential Fed rate cuts, and a detailed analysis of home inventory.

Fed Decisions and the Possibility of More Rate Cuts

The Federal Reserve has already implemented a 25 basis point (bps) cut in September 2025, bringing the federal funds rate to a range of 4.00%-4.25%. This move, the first in nine months, reflects a response to softening labor market data and controlled inflation. Fed Chair Jerome Powell has signaled that further cuts are likely in Q4, with market expectations pointing to a high probability—around 99%—of another 25 bps reduction at the October 29-30 meeting.

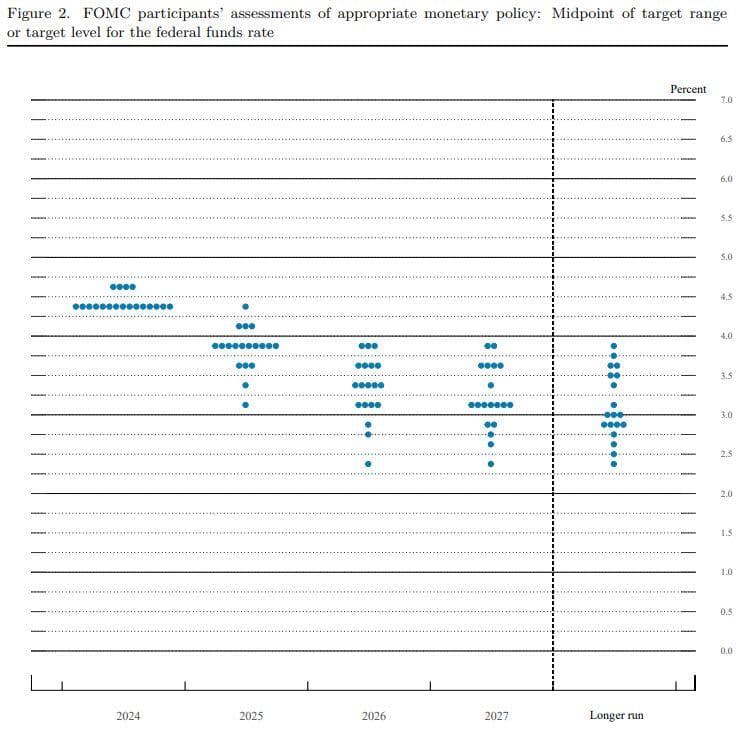

The Fed's dot plot from September indicates a median expectation for the funds rate to fall to 3.50%-3.75% by the end of 2025, implying at least 50 bps of additional cuts this year. Projections suggest one more cut each in 2026 and 2027, settling around 3% long-term. However, the FOMC remains divided, with decisions hinging on upcoming economic indicators like job growth and inflation trends. If labor weakness persists, more aggressive cuts could follow, potentially boosting housing affordability.

Source: cnbc.com

Fed dot plot showing projected federal funds rates through 2027, with median expectations for cuts in 2025.

Trends in Conventional Loan Interest Rates for Q4 2025

Conventional mortgage rates have shown a modest downward trend in Q4 2025, influenced by the Fed's recent cut and anticipation of further easing. As of October 15, 2025, the average 30-year fixed-rate mortgage stands at 6.25%, down from 6.30% a week earlier and marking the lowest in over a month. This follows a peak of 7.04% in January 2025, with rates hovering in the upper 6% range before sliding over the summer.

Weekly data from Freddie Mac and Mortgage News Daily indicate fluctuations: 6.38% on October 9, dropping to 6.31% by October 14. Forecasts suggest rates could average 6.7% for the year, potentially falling to 6% in later quarters if Fed cuts materialize. With inflation slowing, these lower rates are providing some relief to buyers, though high home prices continue to strain purchasing power.

| Date | 30-Year Fixed Rate |

|---|---|

| Oct 15, 2025 | 6.25% |

| Oct 14, 2025 | 6.31% |

| Oct 10, 2025 | 6.32% |

| Oct 9, 2025 | 6.38% |

| Sep 18, 2025 | 6.26% |

Investment DSCR Loan Interest Rates in Q4 2025

Debt Service Coverage Ratio (DSCR) loans, popular among real estate investors for focusing on property cash flow rather than personal income, are also trending downward in Q4 2025. Current rates range from 6.25% to 6.75% as of September 2025, with some lenders offering up to 9.00% based on property type, location, and borrower profile.

DSCR lending saw a 74% growth amid market uncertainty earlier in the year, with rates falling 4 bps to 7.52% by April. The sector is booming due to tighter bank underwriting and investor demand for speed, particularly for multifamily and short-term rental properties. However, rising delinquency rates in commercial real estate (1.57% in Q4 2024) highlight risks, though DSCR loans remain a strong option for scaling portfolios. With Fed cuts on the horizon, expect DSCR rates to continue easing, potentially into the low 6% range by year-end.

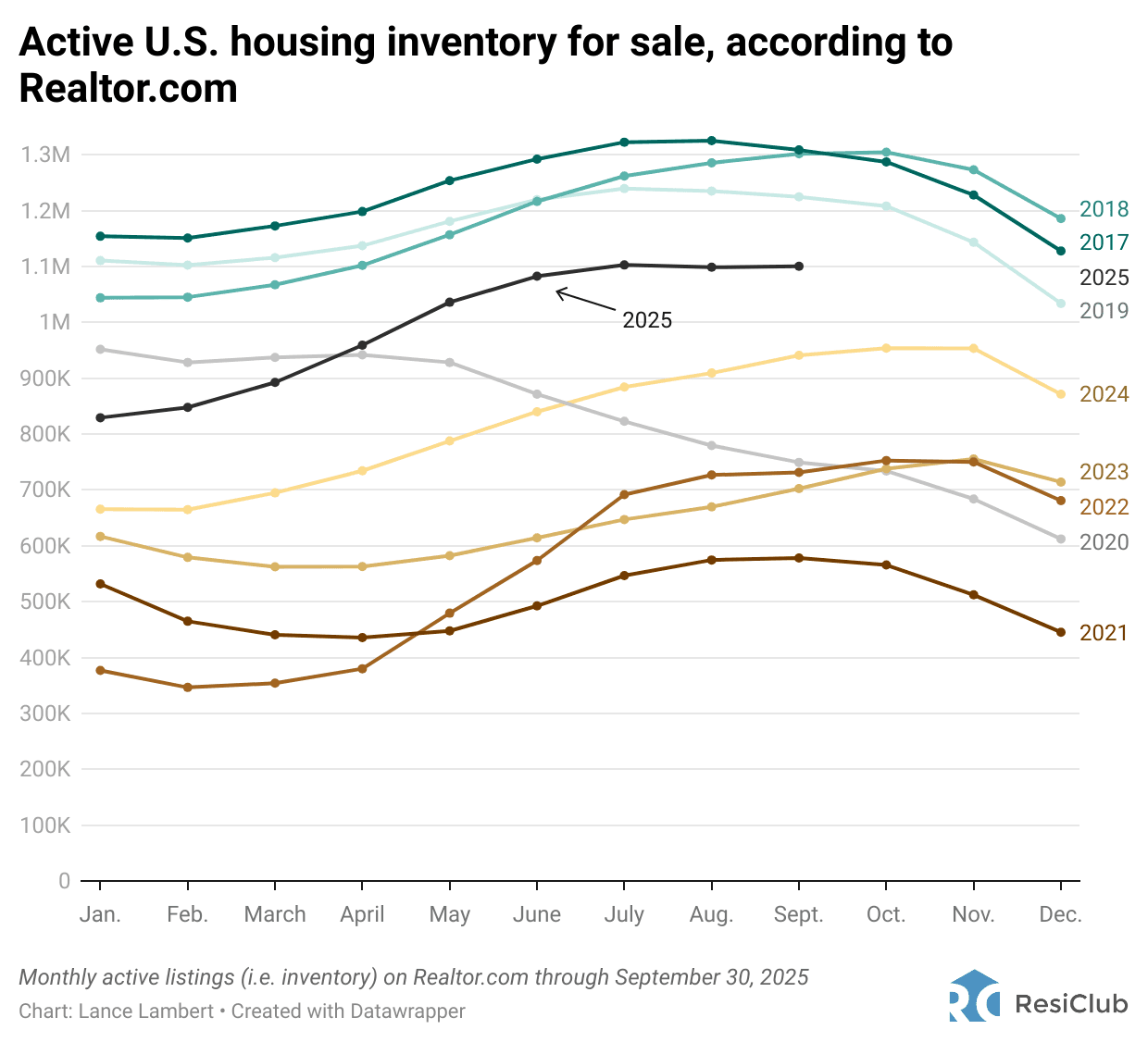

Source: resiclubanalytics.com

Active US housing inventory for sale from 2017-2025, illustrating year-over-year growth in 2025.

Home Inventory Analysis: Signs of Recovery Amid Tight Supply

Home inventory levels in Q4 2025 are showing year-over-year growth, providing some relief in a market plagued by shortages. Existing home inventory stands at 1.53 million units as of the latest data, up from 1.37 million a year ago but down slightly from 1.55 million last month. This represents a 20.9% surge YoY, though levels still lag pre-pandemic norms.

New home inventory has dipped to a 7.4-month supply, 17.8% lower than July 2025, with 490,000 houses for sale at the end of August. Existing-home sales remained flat in August, with subdued price appreciation below 3% nationally. The 'lock-in effect' from low-rate mortgages is slowly easing, contributing to increased listings, but overall supply remains constrained, supporting elevated prices amid slowing demand. Affordability has hit a 25-year high in some metrics, thanks to falling rates, but inventory growth in 15 states above 2019 levels signals regional variations.

| Metric | Value (Q4 2025) | YoY Change |

|---|---|---|

| Existing Home Inventory | 1.53M | +11.7% |

| New Homes for Sale | 490K | -1.4% (MoM) |

| Months' Supply (New) | 7.4 | -17.8% (from July) |

Conclusion: Opportunities and Challenges Ahead

In Q4 2025, the housing market is at a crossroads, with Fed rate cuts poised to lower borrowing costs for conventional and DSCR loans, potentially stimulating activity. While inventory is rebounding, tight supply and reduced purchasing power from inflation slowdowns continue to challenge buyers. Investors using DSCR loans may find opportunities in multifamily properties, but monitoring Fed decisions will be key. As rates trend downward, now could be a strategic time to enter the market—consult professionals for personalized advice.

💡 Key Takeaway

The combination of falling interest rates, improving inventory, and Fed policy shifts creates a unique window of opportunity for both homebuyers and real estate investors in Q4 2025. Those who act strategically now may benefit from more favorable conditions than we've seen in over a year.